Zakat is an important concept in Islam, and one of the five pillars of the faith. It is a form of obligatory charity that requires Muslims to give a portion of their wealth to those in need, especially relatives. The word Zakat comes from the Arabic word “zakaa”, which means purification, growth, and blessings. In essence, it is seen as a way to purify one's wealth and to gain blessings from Allah.

Zakat is considered a duty that is incumbent upon every adult Muslim who possesses wealth above a certain threshold, known as Nisab. This threshold is determined based on the value of silver, Gold, cash, gold, silver, investments, and business inventory. The common minimum amount for those who qualify is 2.5% or 1/40 of savings and wealth.

Benefits of Zakat

Zakat is a vital part of Islam that promotes social justice, community, and compassion. It is a way to purify one's wealth and to gain blessings from Allah, while also helping those in need. By giving Zakat, Muslims are able to contribute to the betterment of society and to fulfill their religious obligations.

One of the benefits of Zakat is that it helps to promote a sense of gratitude and humility in those who give. It reminds us that our wealth is a gift from Allah and that we are responsible for sharing it with others. It also encourages us to be mindful of the needs of those around us, and to be generous and compassionate.

In addition to the spiritual benefits, Zakat has a significant impact on the economy. It helps to stimulate growth and development, as it allows those who are in need to invest in their own businesses and education. It also promotes social stability, as it helps to reduce inequality and prevent the formation of an underclass.

Zakat's Impact on the Economy

Zakat, one of the five pillars of Islam, has a significant impact on the economy of Muslim countries and communities. The payment of Zakat not only fulfills a religious obligation but also has numerous positive economic effects.

First and foremost, Zakat serves as a means of redistributing wealth from the rich to the poor, thus helping to reduce poverty and income inequality. This redistribution of wealth stimulates consumer spending and boosts demand for goods and services, which in turn leads to economic growth and development.

In addition, Zakat can act as a catalyst for entrepreneurship and job creation. The recipients of Zakat are often encouraged to invest the funds they receive in business ventures or to acquire new skills, which can lead to the creation of new jobs and the expansion of the economy.

Zakat also promotes social cohesion and encourages the development of social welfare programs. Through the payment of Zakat, individuals and communities are able to provide assistance to those who are less fortunate, thereby fostering a sense of compassion and community responsibility.

So, the payment of Zakat has a significant impact on the economy of Muslim countries and communities. Through its emphasis on wealth redistribution, entrepreneurship, social welfare, and government funding, Zakat promotes economic growth, development, and stability while fulfilling a fundamental religious obligation.

Zakat Asset and Calculation

The calculation of Zakat is based on several factors, including the amount and type of assets that an individual possesses. Here is a general guideline on how to calculate Zakat:

Determine your Nisab: The first step in calculating Zakat is to determine whether you meet the threshold for giving Zakat, which is the Nisab. The Nisab is the minimum amount of wealth that a person must possess in order to be obligated to pay Zakat.

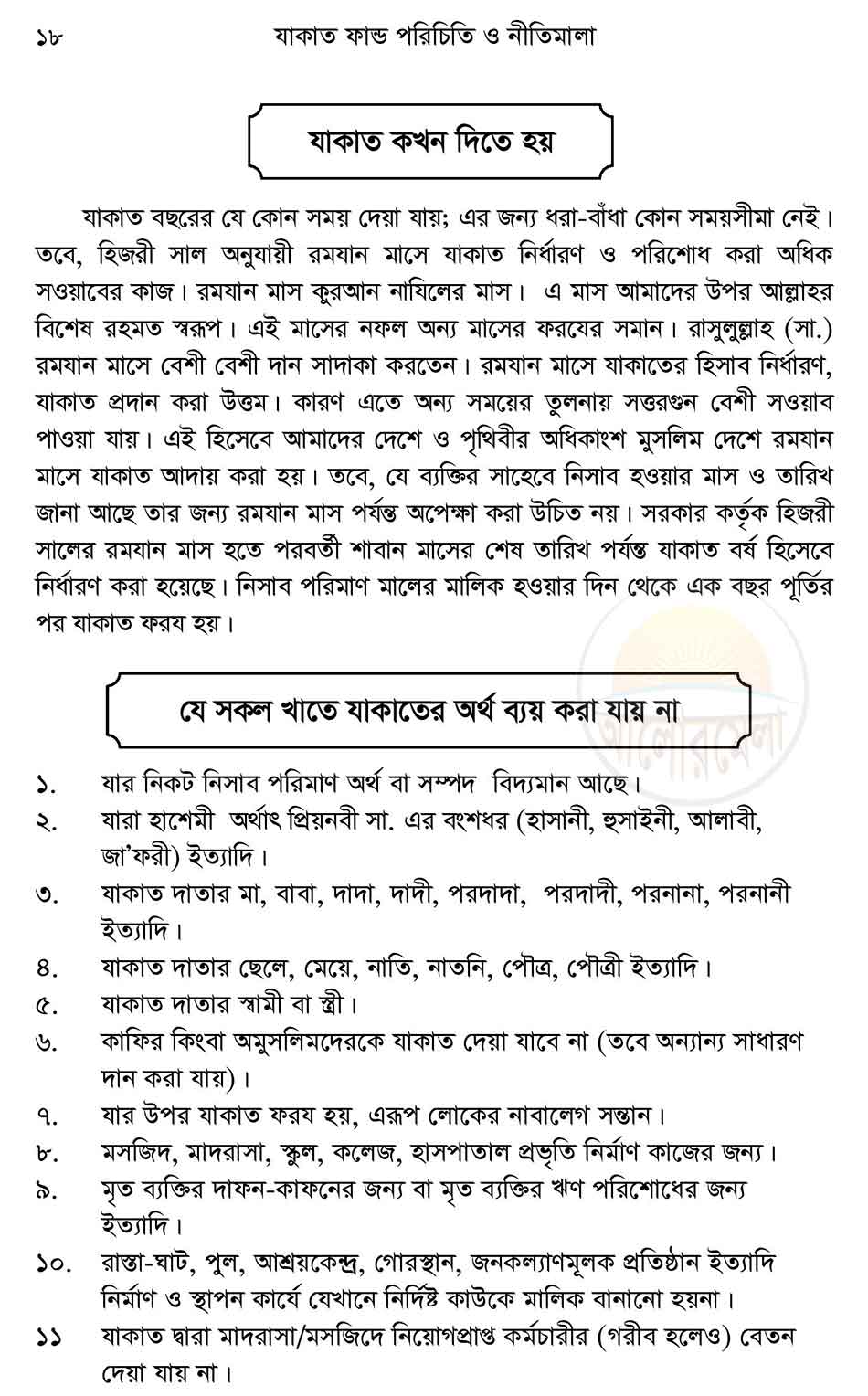

Identify your Zakatable assets: Zakat is only applicable to certain types of assets, including cash, gold, silver, investments, and business inventory. Non-Zakatable assets include personal items such as a home, car, and furniture.

Calculate your Zakatable assets: Once you have identified your Zakatable assets, you need to calculate the total value of those assets. This includes adding up the value of your cash, gold, silver, investments, and business inventory.

Give your Zakat: Once you have calculated your Zakat, you should give it to those in need as soon as possible. The recipients of Zakat should be individuals or organizations who are considered eligible according to Islamic law.

It is important to note that Zakat is an annual obligation, and it is typically paid during the Islamic lunar month of Ramadan. It is also important to consult with a knowledgeable Islamic scholar or financial advisor to ensure that your Zakat calculation is accurate and in accordance with Islamic law.

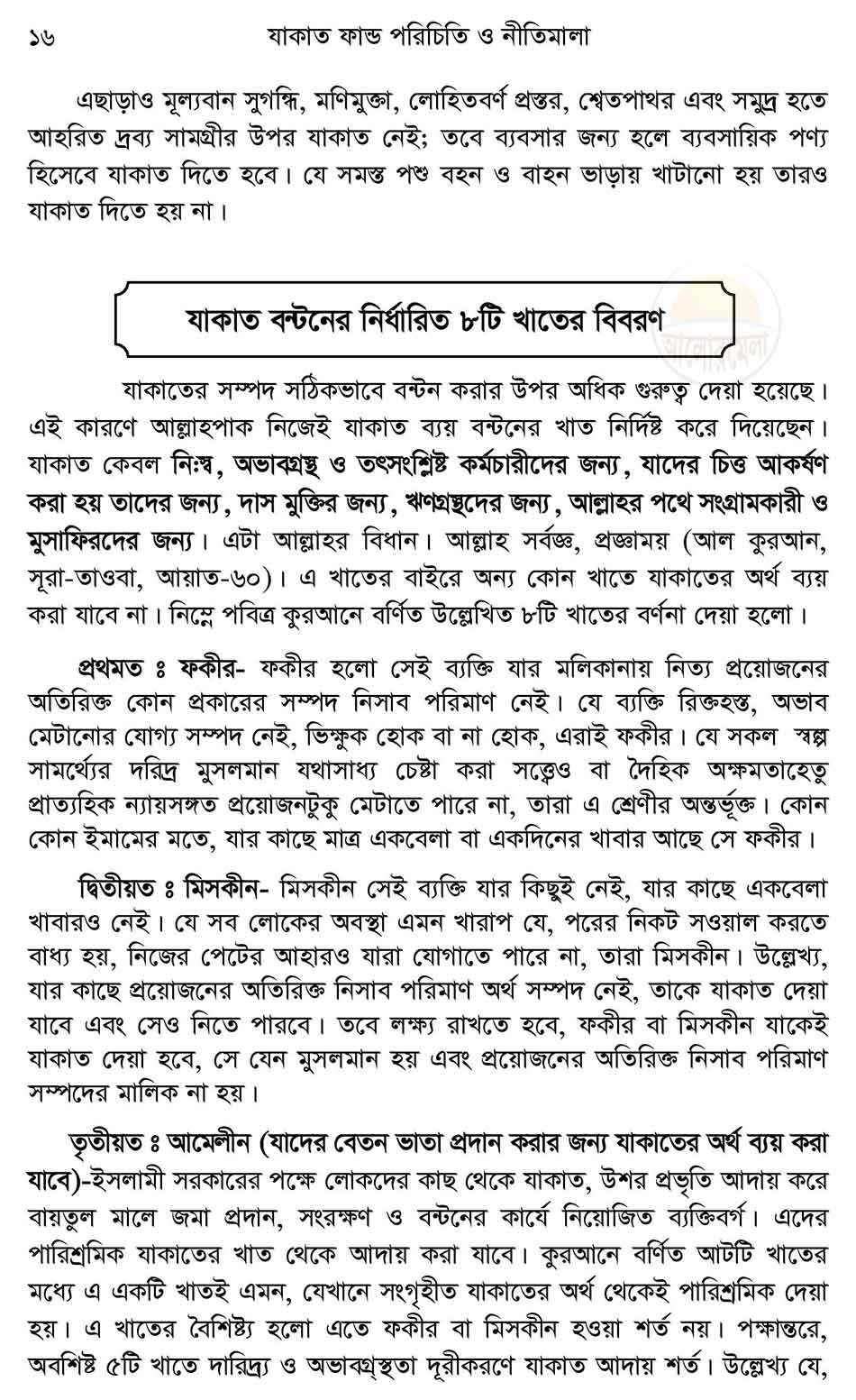

Distribution of Zakat

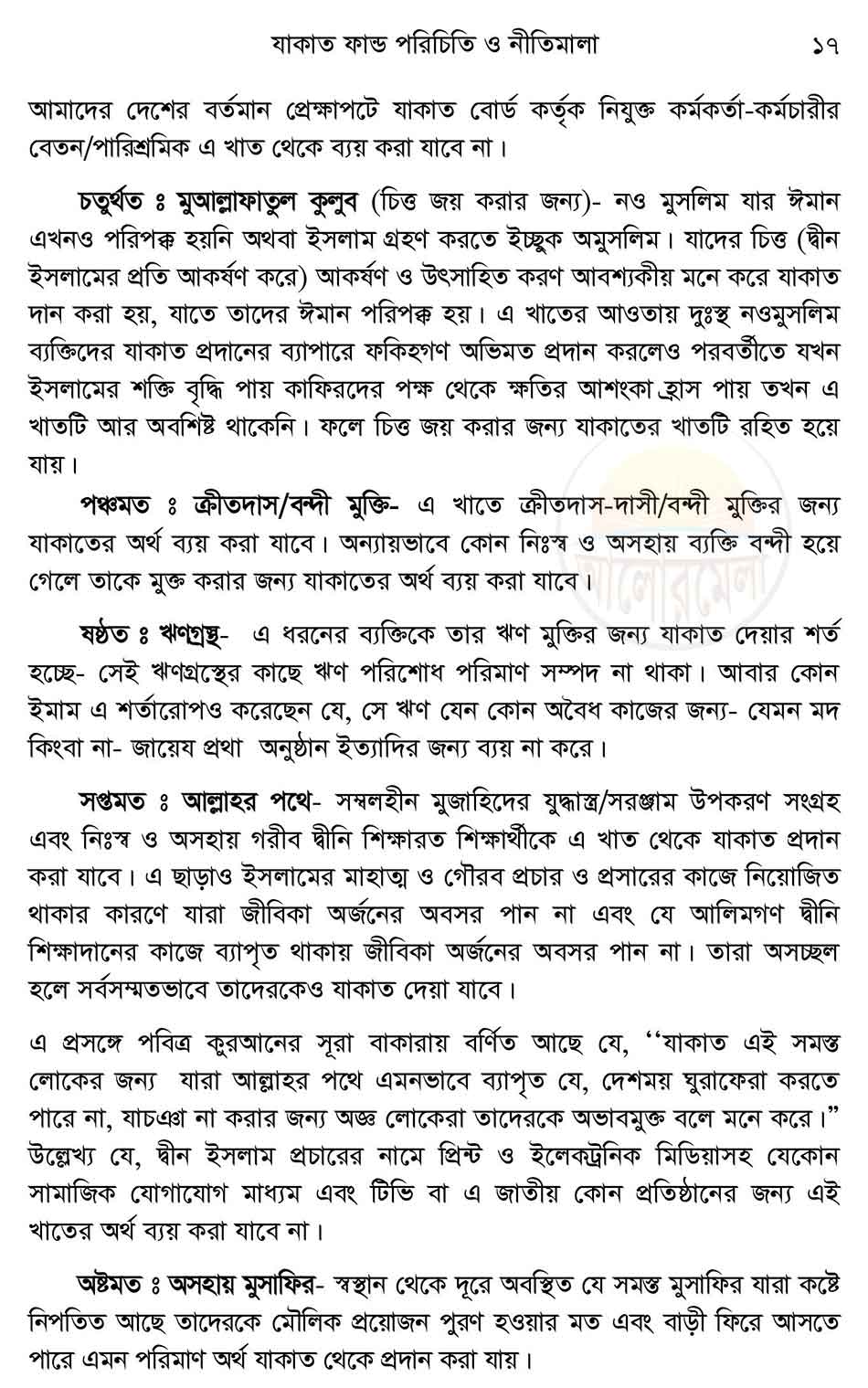

The distribution of Zakat is very specific and structured in Islam. It is primarily given to those who are considered eligible, or "mustahiq", which includes the poor, poor relatives, the needy, those in debt, those who are stranded while traveling, and those who are fighting in the cause of Allah. It is not to be given to those who are wealthy or financially secure, nor to be used for non-charitable purposes. It is important to distribute properly as it is as like a donation to the poor.

Zakat helps to alleviate poverty and to ensure that everyone has access to the basic necessities of life. It also promotes a sense of community and solidarity, as financially secure people are obligated to support those in need. This charitable task makes a strong social relationship.

Zakat at a Glance

Obligation: Zakat is an obligatory act for Muslims who possess wealth above the Nisab threshold.

Nisab: The Nisab is the minimum amount of wealth an individual must possess in order to be obligated to pay Zakat.

Zakatable assets: Zakat is only applicable to certain types of assets, including cash, gold, silver, investments, and business inventory.

Zakat rate: The Zakat rate is 2.5% of the total value of one's Zakatable assets.

Recipients: Zakat should be given to those who are considered eligible according to Islamic law, including the poor, the needy, those in debt, those who are stranded while traveling, and those who are fighting in the cause of Allah.

Best Timing: Zakat is an annual obligation and is typically paid during the Islamic lunar month of holy Ramadan.

Intent: Zakat must be given with the intention of fulfilling one's religious obligation and seeking the pleasure of Allah.

It is important to note that Zakat is considered a spiritual obligation in Islam and should be given with sincerity and compassion. Additionally, consulting with a knowledgeable Islamic scholar or financial advisor is recommended to ensure that Zakat is given in accordance with Islamic law.